Apollo Commercial Stock: Solid Dividend Coverage Turns This CRE Trust Into A Buy (Upgrade) |

您所在的位置:网站首页 › dividend payment › Apollo Commercial Stock: Solid Dividend Coverage Turns This CRE Trust Into A Buy (Upgrade) |

Apollo Commercial Stock: Solid Dividend Coverage Turns This CRE Trust Into A Buy (Upgrade)

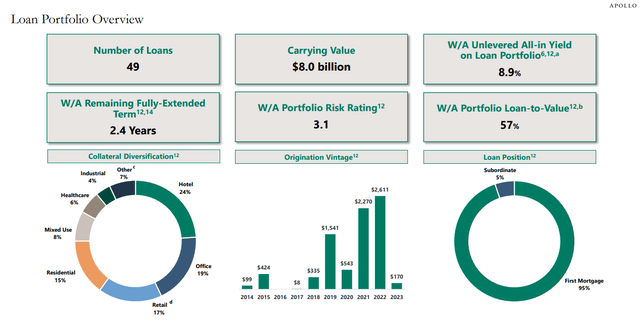

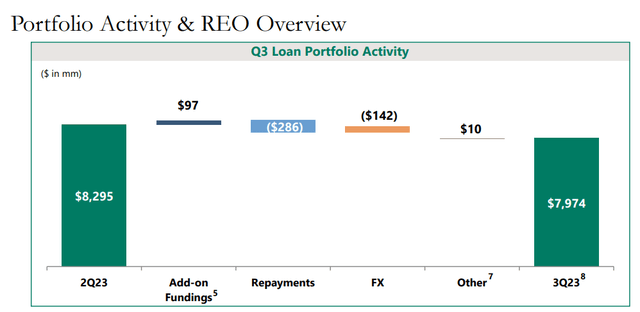

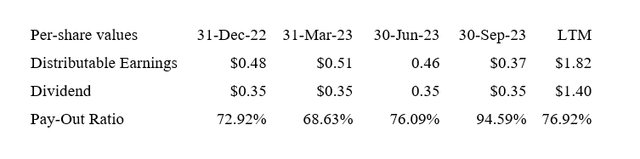

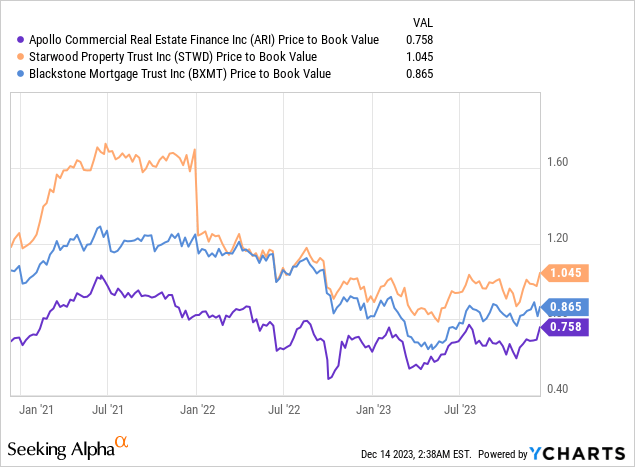

EschCollection The mortgage loan origination business could receive new impulses from lower interest rates in 2024 which is why I modify my stock classification for Apollo Commercial Real Estate Finance Inc. (NYSE:ARI) from Hold to Buy. I think that the central bank is going to slash key interest rates next year and the market expectation is now for at least a full 1% decline in interest rates in 2024. I think this decline in key interest rates could boost Apollo Commercial Real Estate Finance鈥檚 loan origination business and ultimately result in higher distributable earnings. In the third quarter, Apollo Commercial Real Estate Finance had a dividend pay-out ratio of 95%, which is high and reflects high dividend risks, but the twelve months pay-out ratio was substantially lower. Thus, I think Apollo Commercial Real Estate Finance could make it through the next cycle phase without cutting its dividend. My Rating HistoryApollo Commercial Real Estate Finance has profited from an uptick in earnings and improved dividend coverage which explained my rating classification change from Sell to Hold in September. With inflation now moderating, the central bank is poised to slash interest rates next year which in turn should lead to incremental loan mortgage origination growth for Apollo Commercial Real Estate Finance. Apollo Commercial Real Estate Finance Set To See A Rebound In Its Loan Business, Slowing RepaymentsApollo Commercial Real Estate Finance鈥檚 portfolio valued dropped again in the third quarter as the lending situation remained strained. The central bank鈥檚 aggressive push to hike rates can be blamed for the slowdown in new originations and accelerated loan repayments of its borrowers. Apollo Commercial Real Estate Finance鈥檚 portfolio consisted of $8.0 billion worth of mortgage loans at the end of the third quarter which is down from $8.7 billion at the end of 2022. Of the present portfolio, 95% were so-called first mortgages and 99% of loans were floating-rate.  Loan Portfolio Overview (Apollo Commercial Real Estate Finance) Despite higher repayments and a declining portfolio value, Apollo Commercial Real Estate Finance retains a considerable amount of interest rate risk. With that being said, though, the commercial trust is set to see a rebound in its loan originations as inflation has moderated quite substantially in 2023. Moderating inflation takes pressure off of short-term interest rates which in turn should benefit Apollo Commercial Real Estate Finance鈥檚 loan originations. Besides higher interest rates, repayments have been a problem for the trust in 2023. Weighed down by high interest costs, borrowers have chosen to accelerate their repayments as a means to save money. In the third quarter, $286 million in loans were repaid to the trust compared to just $97 million in new funding. The lack of new loan originations and an accelerated pace of loan repayments have led to the decline in Apollo Commercial Real Estate Finance鈥檚 portfolio value.  Portfolio Activity & REO Overview (Apollo Commercial Real Estate Finance) Office portfolioApollo Commercial Real Estate Finance has office exposure which I think has been one reason why the trust鈥檚 stock has sold for a large discount to book value in the last year. I have pointed out before in many articles how headwinds in the office commercial real estate market impacted transaction prices and vacancies in the sector. Based on the trust鈥檚 last investor presentation, 19% of Apollo Commercial Real Estate Finance鈥檚 portfolio is linked to office loans. With that being said, though, with interest rates set to decline next year, according to the CME FedWatch Tool, the market overwhelming expects key interest rates to fall to a level of 4.00-4.50% a year from now, compared to a key interest range of 5.25-5.50% today. Lower interest rates could resuscitate Apollo Commercial Real Estate Finance鈥檚 loan origination business in 2024 and at the same time slow its trust鈥檚 loan repayments. Will Apollo Commercial Real Estate Finance Have To Slash Its Dividend Pay-Out?Apollo Commercial Real Estate Finance earned $0.37 per share in distributable earnings in the third quarter which is the same the trust earned in the third quarter last year. The pay-out ratio has risen in 3Q-23, to 95%, but on a twelve months basis the ratio facilitated the easy payment of the $0.35 per share per quarter dividend. The dividend pay-out ratio in the last twelve months was 77% and I am starting to think that the trust could transition into the next cycle phase without slashing its dividend.  Dividend (Author Creation Using Company Supplements) For Whom Apollo Commercial Real Estate Finance Is An Appropriate InvestmentAs the trust鈥檚 12.2% yield suggests, Apollo Commercial Real Estate Finance鈥檚 dividend is not without risk. With that being said, though, I think that risks associated with the yield have decreased lately, primarily due to decreasing pressure on consumer prices and short-term interest rates. As the central bank鈥檚 high-rate cycle phase is coming to an end, Apollo Commercial Real Estate Finance is poised to see a re-invigoration of its loan origination business. A potential alternative for passive income investors that are concerned about dividend stability is Starwood Property Trust Inc. (STWD) which offers passive income investors a well-diversified portfolio including assets other than loans and a decade-long history of paying $0.48 per share per quarter. Apollo Commercial Real Estate Finance is still selling for a relatively large 24% discount to book value which, in my view, reflects the risks associated with its 12.2% dividend yield. Apollo鈥檚 peers in the loan origination business sell for smaller discounts to book value which reflects their more diversified business models and lower office exposure.  Data by YChartsWhy An Investment Might Not Pay Off Data by YChartsWhy An Investment Might Not Pay Off There are two risks involved in the ARI investment thesis: Interest rates; and Office exposure.Higher-for-longer interest rates would help the trust鈥檚 short-term distributable earnings potential (due to its floating-rate exposure), but weaken its origination business. An increase in defaults within the office market wouldn't contribute positively to earnings growth. Looking ahead, I anticipate improvements in the office market's fundamentals over the long term. This improvement is likely to be driven by lower interest rates and a stronger overall credit quality. My ConclusionThe overall risk situation has further improved and the end of the central bank鈥檚 rate-hiking cycle will ultimately be a good development for Apollo Commercial Real Estate Finance because it could kick off a new phase of growth for its loan originations. In a high-rate environment, borrowers and investors tend to shy away from high-interest loans which has suppressed Apollo Commercial Real Estate Finance鈥檚 originations and led to accelerated repayments. With inflation moderating and short-term interest rates set to decline in 2024, I think that Apollo Commercial Real Estate Finance is an increasingly compelling passive income investment, but none without risk. Taking into account the large discount to book value and robust twelve months dividend pay-out ratio, I am sold on the 12.2% yield. Buy. |

【本文地址】

今日新闻 |

推荐新闻 |